Car buyers with extra disposable income may wish to consider a flexible type of variable rate car loan that allows them to reduce the interest by depositing extra money into a linked account much like how a flexi home loan works. There are a few factors that determine your eligibility and may differ from bank to bank.

Loan Interest Rates Flat Rates Vs Fixed Rates Vs Variable Rates Loan Interest Rates Personal Loans Bugeting

Adjustable Rate Home Loan ARHL.

. The interest rate in an ARHL is linked to HDFCs benchmark rate ie. Find out the savings in EMI. An HDFC home loan customer can choose between two types of interest rate options while availing a home loan.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. At 340 pa the total interest you are paying every year is RM335988 which is equivalent to RM27999 per month. Multiply that number by your remaining loan balance to find out how much youll pay in interest that month.

The amount of financing you need or should apply for depends on your personal circumstances. For example if the current BR rate is 400 Update. Borrow up to 75.

The more you pay the more interest you save and the sooner the loan will be settled. If you have a 5000 loan balance your first month of interest would be 25. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR.

Login to online banking. This calculator helps you estimate your home loan eligibility and what is the maximum amount you can borrow. For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding.

Interest Rate pa 0 15. Get your loan approved in 60 seconds before visiting the showroom. Tenure Years 1 30.

These are as follows. If you take up 70 depending on the Open Market Value of the car financing you will not have to find as much cash in the short term. How much loan could I borrow.

Retail Prime Lending Rate. Enjoy significant savings with Eco-Care Car Loan. Borrow up to 7 years and 70 of the purchase price or our valuation of the car whichever is lower.

You can repay your loan on a monthly basis via Interbank GIRO IBG cash deposit cheque deposit or MEPS ATM fund transfer. The information provided on this website is for general education. Own your dream home faster.

An Adjustable Rate Home Loan is also known as a floating or a variable rate loan. Cash Deposits go immediately towards reducing the outstanding principal loan amount. Be informed and get ahead with.

You can apply for a Home Loan at any time once you have decided to purchase or construct a property even if you have not selected the property or the construction has not. In Malaysia most car loans are the fixed rate variant. Borrow up to 75 of the cost to build or enhance your dream home.

So if you break the monthly installment amount of RM119444 down the principal loan amount minus the interest is only RM915. However in the long run you will pay more money for your vehicle than if you had taken a smaller Amount Financed. A personal loan is an amount of money you can borrow to use for a variety of purposes.

The mortgage principal is 400000. Margin of financing up to 90. Integration of home loan savings and current accounts into one account.

For auto service financing we provide a 3 and 6 times monthly instalment for up to RM5000. About home loan specialists. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR.

For private sector personal loan you can borrow up to RM20000 with loan terms between 1 and 4 years. Monthly net income after income tax EPF and SOCSO Existing Monthly Debt Repayment other mortgages personal loans and hire purchases. For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the bank to complete the purchase.

Loan tenure of. Find out how much you can borrow with our home loan calculator more.

Applying For A Housing Loan In Malaysia 6 Important Things To Know

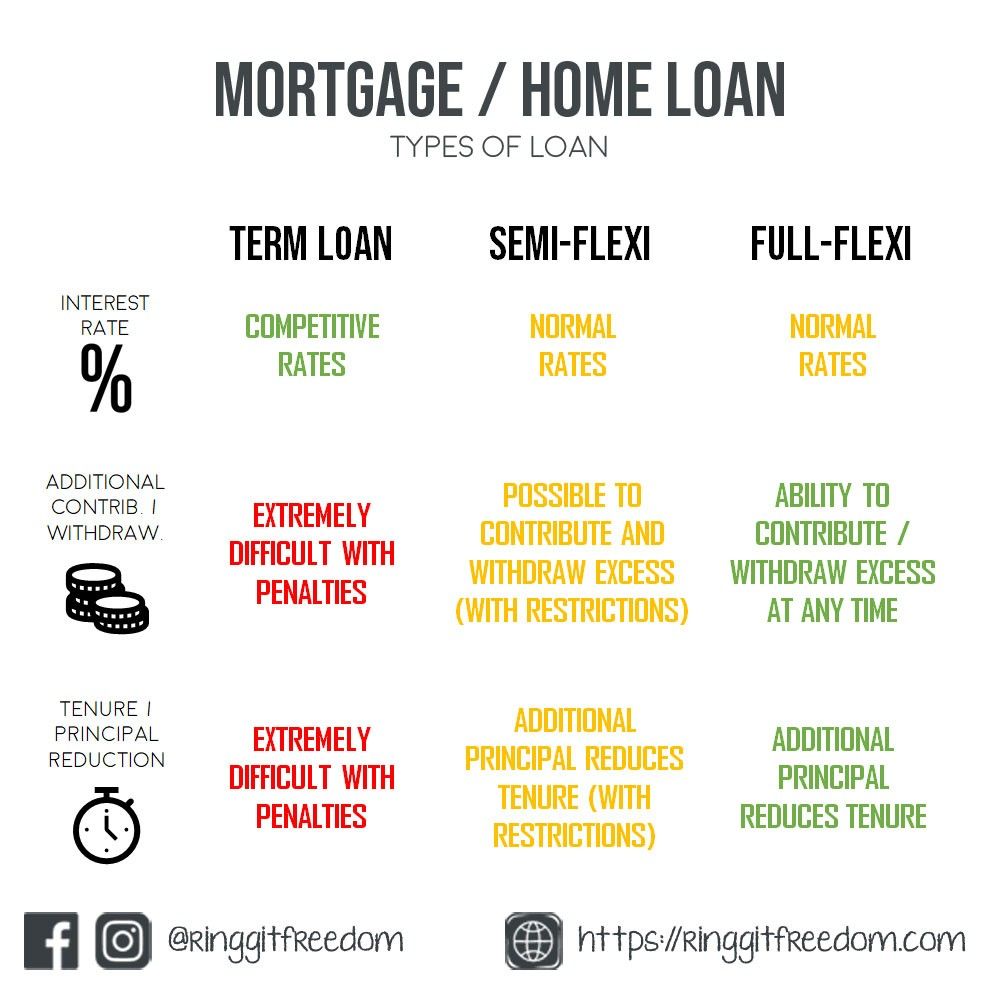

Malaysian S Guide To Mortgage Home Loan Ringgit Freedom

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Everything You Need To Know About Getting A Mortgage Loan For Property In Malaysia Airmas Group

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Housing Loan How To Apply As A First Time Homebuyer In Malaysia Iproperty Com My

Applying For A Housing Loan In Malaysia 6 Important Things To Know

5 Scenarios When Taking A Personal Loan Makes Sense Iproperty Com My

Home Loan Eligibility Affordability Calculator

How To Use A House Loan Calculator In Malaysia

Financial Loan Interest Rates Loan The Borrowers

What S The Real Difference Between Buying Private Property In Singapore And Iskandar We Ll Show You Investing Singapore Investment Property

How Much Home Loan Can You Get Based On Your Salary In Malaysia

How Much Can You Borrow Based On Your Dsr

How To Use A House Loan Calculator In Malaysia

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Malaysian S Guide To Mortgage Home Loan Ringgit Freedom

Applying For A Housing Loan In Malaysia 6 Important Things To Know

Loan To Value Ltv On Residential Mortgage Loans In Malaysia